Find out more about our Compliance Fee Protection Scheme

- TBA

- Nov 27, 2024

- 5 min read

Updated: May 29, 2025

In the past decade, the UK tax authority (HMRC) has frequently conducted surprise audits, with the number of tax investigations increasing significantly each year. For friends running businesses or working in the UK, one of the most stressful issues every year is the tax authority’s audits.

These surprise audits not only create anxiety but also financial pressure. Many clients need to defend themselves against tax investigations and often have to hire accountants and other professionals to gather evidence, organise accounts, etc., resulting in costs amounting to thousands of pounds.

If you are worried about these issues, this post is for you!

Did you know that when HMRC comes knocking, if you have enrolled onto our Compliance Fee Protection Scheme, you can avoid related accounting fees resulting from a tax investigation?

So, what exactly is this service? Is it worth buying? Does it cover all fees? Don’t worry, we will clarify everything for you today.

What is a compliance check?

Let’s briefly explain the basic process of tax audits conducted by HMRC.

When the tax authority suspects that there is a discrepancy between the taxes they should collect from individuals or businesses and the actual taxes collected, they initiate a tax investigation—also known as a ‘compliance check’ —to ensure that individuals and businesses pay the correct amount of tax and address the ‘tax gap’.

Any individual, sole trader, or business can receive an invitation for an investigation, even if you submit your tax returns on time and pay the taxes due. You may also be randomly selected for an audit if your upstream or downstream businesses are being investigated by the tax authority.

HMRC has very advanced technology that allows them to track high-risk or unusual situations at any time.

The most likely triggers for a tax investigation include (but are not limited to):

Late submission of tax returns

Incorrect figures in tax returns or accounts

Reports from others about unusual activity in your accounts

Your industry being deemed ‘high risk’ (e.g. regularly only accepting cash transactions)

Lost information

Inconsistent tax return figures (significant increases or decreases)

Possible undisclosed background activities

Typically, tax investigations can be categorized into three types: aspect queries, full investigations, and random checks. Regardless of the type of investigation, the consequences and costs can be severe.

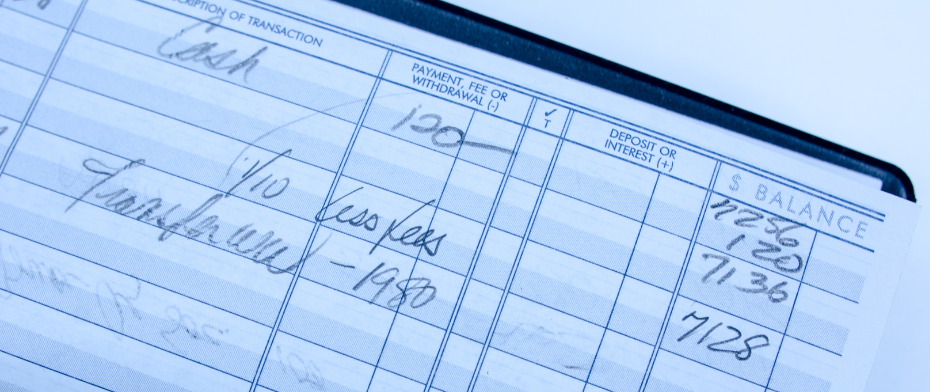

An important part of compliance checks is thoroughly reviewing and verifying your financial records. Before HMRC conducts a compliance check on a taxpayer or business, they will notify you by letter or phone, specifying what they wish to examine, such as:

Any taxes you have paid

Accounts and tax calculations

Self-assessment tax returns

Corporate tax returns

PAYE records and returns if you employ staff

Upon receiving a notice of audit, the taxpayer needs to prepare according to the letter’s instructions.

Due to the complexity of the process, taxpayers or businesses usually require the help of professional accountants or tax experts to navigate through it.

Professionals can assist their clients in gathering and organising all necessary documents, cross-checking the accuracy of all data, and preparing for HMRC’s review.

What is our Compliance Fee Protection Scheme?

As mentioned earlier, each year, HMRC decides whether to investigate the validity of tax returns submitted by taxpayers or businesses or whether to ask the parties to clarify certain issues.

During the investigation, accountants need to assist clients in preparation for the check. This can include organising information for clients, communicating with the tax authority, and finding ways to defend clients, among other tasks—these all take time.

Sometimes, inquiries from HMRC can be delayed, extending the investigation period. As a result, accountants often have to charge clients for these additional costs incurred during the investigation. They typically bill clients for these hours – if the client’s case involves travel to other cities, accountants charge for travel-related expenses, such as hotel fees and transportation costs.

In such situations, taxpayers or businesses can face unexpected expenses, which can be extremely high.

Our scheme introduces a single annual flat-rate fee to alleviate any uncertainties.

What does the Scheme not cover?

Of course, our service does not cover all fees. For example, it does not cover the following situations:

Cases of Fraud:

Cases handled by HMRC’s Fraud Investigation Service, Civil Investigations of Fraud, Criminal Investigation Sections, and the Counter Avoidance Directorate.

Late Submissions:

If a taxpayer or business’s income tax, corporation tax, VAT, or inheritance tax return is submitted more than 90 days after the statutory due date; if the client fails to notify their tax obligations or register for VAT within the statutory deadline.

Voluntary Disclosures:

Investigations due to voluntary disclosures of relevant information to HMRC; taxes due, NIC or VAT liabilities arising from misleading HMRC intentionally; submission of incorrect tax returns to HMRC.

Business Record Expenses:

This audit protection service primarily covers expenses incurred during the audit period. Professional fees incurred while reviewing and/or organizing client business records before HMRC conducts PAYE and/or VAT tax reviews are not included; furthermore, this protection service does not cover accountants’ preparation and verification of returns, accounts, records, or any statutory submissions; costs related to professional assessments, including VAT Returns to accounts, Construction Industry Scheme (CIS) Returns, Real Time Information (RTI) payment submissions; third-party expenses, including property valuations related to SDLT/LBTT/LTT returns (unless prior written consent from the firm is obtained).

Fines/Taxes/Interest:

This plan does not cover fines, interest, or any taxes that taxpayers and businesses must pay.

Why do I need this service?

Given the current reality, the number of investigations by HMRC is significantly increasing and is unlikely to decrease in the near future.

During a tax investigation, you may be asked various complex or confusing questions by audit officials and required to submit more documents and information, often without knowing exactly what HMRC is reviewing or how long the audit will take.

If you purchase this service, you essentially buy ‘peace of mind’ in advance, allowing you to pass everything to your accountant, who will handle the investigation for you.

Some advice from TB Accountants

In the UK, most accounting firms offer some form of fee protection plan to their clients. However, like other insurance policies, the coverage and amounts offered by each service provider will vary.

Different business entities can choose the types of tax compliance reviews covered and the service duration, with limitations on what accounting firms can determine based on the date of the tax authority’s audit letter.

We strongly recommend that you consult professionals and review related content carefully before purchasing; you should specifically look at the scope of reimbursable expenses and the restrictions involved.

For individuals and businesses looking for UK taxation services, use our contact form to get in touch for more information.

Get in touch with us at info@tbgroupuk.com or for a free one-to-one consultation.