Did you know that you can withdraw 25% of your pension tax-free, and invest the rest?

- TBA

- Feb 21, 2024

- 5 min read

Updated: May 29, 2025

If you have opened a personal pension account and are currently making fixed monthly contributions, you’ll want to read ahead. In this article, we’ll provide some general information on how contributions work and how to maximise your returns on withdrawal.

Generally speaking, unless you choose to withdraw all the funds from your pension pot at once, there will be some money left in the pot. How should this money be utilised?

In the UK, there are several options for ‘cashing in’ (withdrawing) – the two main options are a life annuity, or a pension drawdown.

When you purchase a life annuity, your savings are converted into annual pension payments, providing you with either a lifetime or fixed-term income.

If you opt for a pension drawdown, you can withdraw funds from your pension pot and invest the remaining portion. A pension drawdown may seem more flexible, as if investments perform well, there is significant potential for growth in the remaining funds, which could provide you with substantial income. However, this also comes with risks.

We’ll explain how it works, and why you may want to choose one.

1. What is a pension drawdown?

A pension drawdown is a way of withdrawing funds directly from your pension while allowing your pension fund to continue to grow.

You can withdraw some money from your pension savings pool, reinvest the remainder and earn a regular income. Typically, this comes from a defined contribution pension, such as a personal or workplace pension. Before pension drawdown was first introduced in the UK in 1995, pension holders had fewer options.

It was only possible to purchase an annuity before the age of 75 to ensure a stable retirement pension.

The Pension Taxation Act 2014 introduced two types of pension drawdown – capped drawdown and flexible drawdown.

Capped withdrawals mean there is a ‘cap’ on the income that can be received from the pension pool. With a flexible withdrawal, after you withdraw the available tax-free amount, the remainder can be used to provide regular income and/or temporary lump sum payments, with no limit on the amount.

After 6 April 2015, it is no longer possible to initiate a capped drawdown. However, any drawdown initiated on 5 April 2015 or before can still be maintained.

2. How does a pension drawdown work?

After 6 April 2015, the upper limit withdrawal was cancelled, and the flexible withdrawal method was officially renamed to ‘flexi-access drawdown’.

Therefore, in this article, we mainly introduce Flexi-access Drawdown and its operating rules.

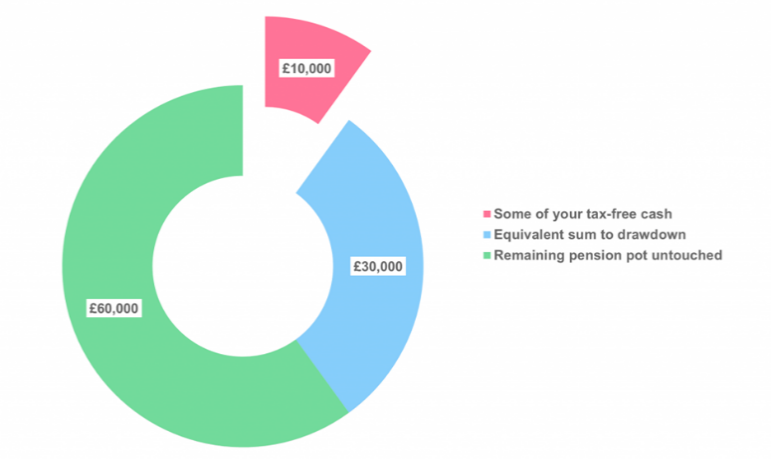

From the age of 55, pension holders can withdraw up to 25% of their funds from their pension savings pool tax-free, and the rest of the funds (up to 75%) will be automatically moved to a drawdown account. The 25% tax-free withdrawal can be withdrawn at once, or in increments.

When the remaining funds enter the drawdown account, you can then decide how to invest the money and receive a regular taxable income. You can also talk to a financial advisor who can assist with how to best manage these funds, and what investment options are available.

There is no limit to how much income you can withdraw from your remaining pension savings.

It can be taken all at once, or via regular withdrawals (e.g. monthly or yearly). After 6 April 2015, the flexi-access drawdown scheme allows you to withdraw unlimited amounts.

3. Some examples:

Example 1:

You are aged 60, and want to use your pension savings to pay off debts and for some emergency home repairs

You have a total of £100,000 in your pension pot

You can withdraw up to £25,000 tax-free (25%)

You can invest the remaining £75,000

In this case, the investment of £75,000 will be taxed at withdrawal. However, since the investment has a chance to appreciate (or depreciate), there is a chance that the final withdrawal amount may be higher or lower after tax.

Example 2:

You are aged 60

You have a total of £50,000 in your pension pot

You can withdraw up to £12,500 tax-free (25%)

You have £37,500 remaining which can be invested and/or withdrawn as regular income

You decide to withdraw £2000 per year from the remaining amount as income

In this case, you can change the withdrawal amount of £2000 whenever you prefer, or you can stop making withdrawals entirely. As in the above example, the remaining amount that is not withdrawn is invested, and the amount can appreciate or depreciate.

4. Benefits and risks

There are many advantages to using a pension drawdown as part of your retirement plan, but there are also some limitations and potential risks.

Advantage 1: Flexibility

Pension Drawdown gives you the flexibility to arrange how you want to use your pension to suit your retirement plans and circumstances.

Advantage 2: Control of Taxes

You’re usually entitled to a 25% tax-free lump sum, and any withdrawals above this are taxed at your marginal tax rate.

However, you have control and can time your withdrawals. For example, if you are currently a high-rate taxpayer but will soon become a basic-rate taxpayer, you can wait before making any further withdrawals.

Advantage 3: Investments

Investing remaining funds makes it possible for your funds to continue to grow.

Risk 1: Market volatility

Your remaining pension in a drawdown account will continue to fluctuate in value, depending on your investments and market conditions. If you withdraw funds faster than your investments grow, your remaining funds will decrease in value and may not be sufficient to maintain the level of income you wish to withdraw.

Risk 2: Money Purchase Annual Allowance (MPAA)

The amount you can contribute to a pension each year is £60,000. However, if you draw down your pension (more than the 25% tax-free cash lump sum), your annual allowance will be reduced to £10,000. If you want to semi-retire but continue to contribute to your pension, this could significantly impact your long-term retirement plans.

Risk 3: Persistence

While you have its flexibility and options, it’s your responsibility to ensure that your money can live as long as you do. Many of us underestimate how long we are likely to live, so judging how much money to withdraw sustainably can be difficult.

5. Tax rules

The first 25% of your pension is tax-free. After, any subsequent earnings you withdraw from the drawdown account pool will be subject to personal income tax (at the time of writing, 2023-24 rates):

If you have no income from any other source, the first £12,570 is tax-free.

You pay tax at 20% on the next £37,700 above this.

You pay 40% tax on all income over £50,270 (£12,570 + £37,700)

You pay 45% tax on everything above £125,140.

So if you took out £50,270 and had no other income from private pensions and state pensions, your tax bill would be £7540, after taking into account your tax-free allowance of £12,570.

These income tax rates apply to England, Wales and Northern Ireland. There are different income tax rates in Scotland.

6. How do I pick the best option for myself?

TB Accountants recommends that you should always seek professional advice to determine whether a pension drawdown is the right choice for your needs.

If you do decide to use a pension drawdown, you will also need to decide how much to leave in your drawdown account.

It is best to seek professional advice regarding the relevant tax rules for withdrawing the remainder, and see how best to maximise the benefits. Any investment strategy must be best suited for your investment purposes. If you are still unsure how to proceed, contact TB Accountants for more advice.

For individuals and businesses looking for UK taxation services, use our contact form to get in touch for more information.

Get in touch with us at info@tbgroupuk.com or for a free one-to-one consultation.